When it comes to mutual fund investment, it has been a consistent option for investments due to higher returns by potential buyers.

Even though, understanding the concept of tax implications associated with mutual fund investments is critical in order to make well-informed judgments when investing in mutual funds. This article describes the many forms of taxes that apply to mutual funds in India based on their exposure to domestic equity shares. The article also discusses the tax rates for short-term and long-term capital gains, as well as the tax consequences of various types of mutual funds. Investors can make informed decisions that match with their financial goals and prevent tax-related shocks by knowing the tax implications of mutual fund investments.

The following is an explanation of the many types of mutual funds and their tax implications:

Equity Mutual Funds – Equity mutual funds invest majorly in company stock. Long-term capital gains (LTCG) from the sale which after more than a year of equity mutual funds of ownership can be taxed at 10% without indexation. On the other way, short-term capital gains (STCG) on equity mutual funds are taxed at 15%.

Debt Mutual Funds – Debt mutual funds investments are mainly done in fixed-income securities such as bonds, debentures, money market instruments, etc. LTCG from debt mutual funds are generally taxed at 20% with indexation, while STCG is taxed as per the investor’s income tax slab rate.

Hybrid Mutual Funds – Hybrid mutual funds invest in both equity and debt instruments, to offer the best of both worlds. The tax implications of hybrid mutual funds depend on their asset allocation. If the equity allocation is more than 65%, the fund is taxed as an equity fund while If the debt allocation is more than 65%, the fund is taxed as a debt fund.

Tax-Saving Mutual Funds – An Equity-linked saving scheme or known as ELSS is a kind of equity mutual fund that is eligible for tax gains under Section 80C of the Income Tax Act,1961. Investments in ELSS funds up to INR 1.5 lakh qualify for a tax deduction.

Index Mutual Funds – Index mutual funds invest in a stock markets index like the Nifty or the Sensex. The tax implications of index mutual funds are the same as equity mutual funds.

Fund of Funds – A Fund of Funds or known as FoF invests in other mutual funds. So, the tax implications of FoF usually depend on the type of underlying mutual fund they invest in.

| Exposure to equity shares of domestic companies | 0-35% | 35-65% | > 65% |

| STCG | Marginal Tax rate | Marginal Tax rate | 15% without indexation |

| LTCG | Marginal Tax rate | 20% with indexation After 3 year holding period | 10% without indexation After 1 year holding period |

| Applicable To | 1. All debt funds 2. Gold ETF 3. International FoF 4. Conservative hybrid funds 5. Dynamic asset allocation funds 6. Multi-asset funds | 1. Balance hybrid funds | 1. All domestic equity funds 2. Equity savings funds 3. Arbitrage funds 4. Balanced Advantage funds 5. Aggressive Hybrid funds |

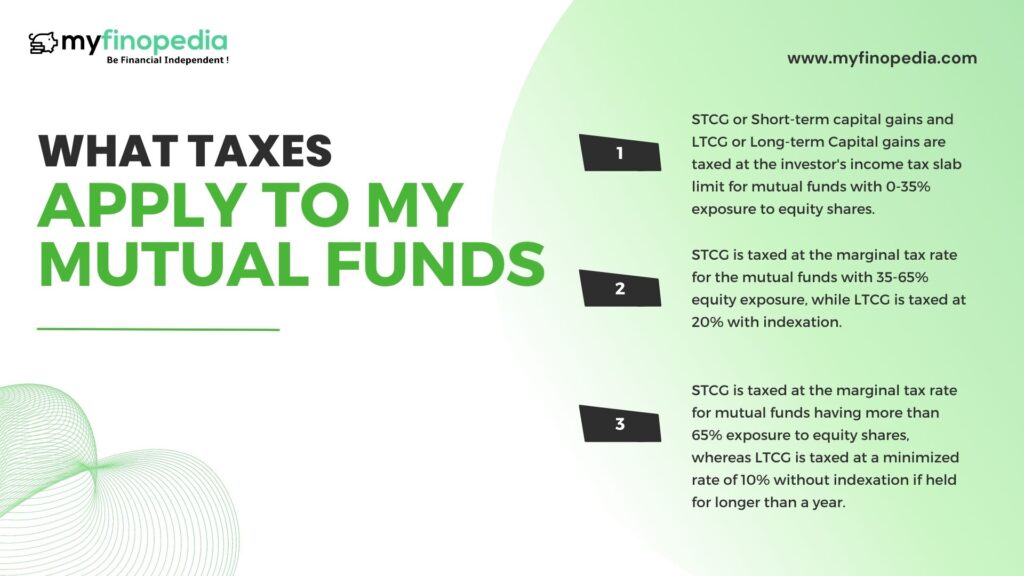

The table provided outlines the tax implications of investing in mutual funds based on their exposure to equity shares of domestic companies.

- STCG or Short-term capital gains and LTCG or Long-term Capital gains are taxed at the investor’s income tax slab limit for mutual funds with 0-35% exposure to equity shares.

- STCG is taxed at the marginal tax rate for the mutual funds with 35-65% equity exposure, while LTCG is taxed at 20% with indexation.

- STCG is taxed at the marginal tax rate for mutual funds having more than 65% exposure to equity shares, whereas LTCG is taxed at a minimized rate of 10% without indexation if held for longer than a year.

All debt funds, equity savings funds, balanced hybrid funds, arbitrage funds, balanced advantage funds, aggressive hybrid funds, and all domestic equity funds come under these tax rates.

Finally, while making investment decisions, investors should consider the tax consequences of the mutual funds. It is advised that you speak with a financial professional to properly know the tax consequences and make informed investment decisions. While doing investments in mutual funds, investors must consider the various tax implications. Different tax rates and rules apply depending on the specific kind of mutual fund, the holding period, and the investor’s income tax bracket. To properly know the tax consequences of mutual funds, investors should speak with a financial professional.