Non-Convertible Debentures or NCDs are fixed income instrument issued by a company in order to get long-term investment benefits that carry a secured amount of interest for the investor at a certain rate.

Here we shall look through some of major nuances of NCDs and why are they different from bank FDs:-

What is NCD?

Non-convertible means that cannot be converted into shares, that means once the tenure is over, the owner can get the money back in liquefied amount, unlike other stock exchanges. When compared to convertible debentures, they provide superior returns, liquidity, low risk, and tax benefits to investors.

NCDs can be of two types : – Secured NCDs and Unsecured NCDs.

Secured NCDs are one that are safer of the two types since they are backed by the company’s assets. If the company fails to pay on time, the investors can recoup their losses by liquidating the company’s assets. In this case, the interest rates on NCDs are low.

On the other hand, Unsecured debts has higher rate of interests compared to Secured ones, but are very risky in terms of redemption as they are not backed by the company’s assets. So, there remains no option for the investor but to wait until they receive their recovery of the dues.

If the bank accepts FDs at 6%, it can offer loans to cash-strapped businesses at 8% or 9% while still earning 1-2%. Nevertheless, bank loans are not taken at 8-9% by these companies and instead they form public deposits in the form of NCDs at 9-10%. The reason is bank considers it RISKY to lend or extend credit to these businesses. As a result, investors are spared the risk.

How does NCDs work?

They are usually used by businesses to raise long-term funds through a public offering. Interest payments can be made per month, quarterly, semi-annually, or annually.

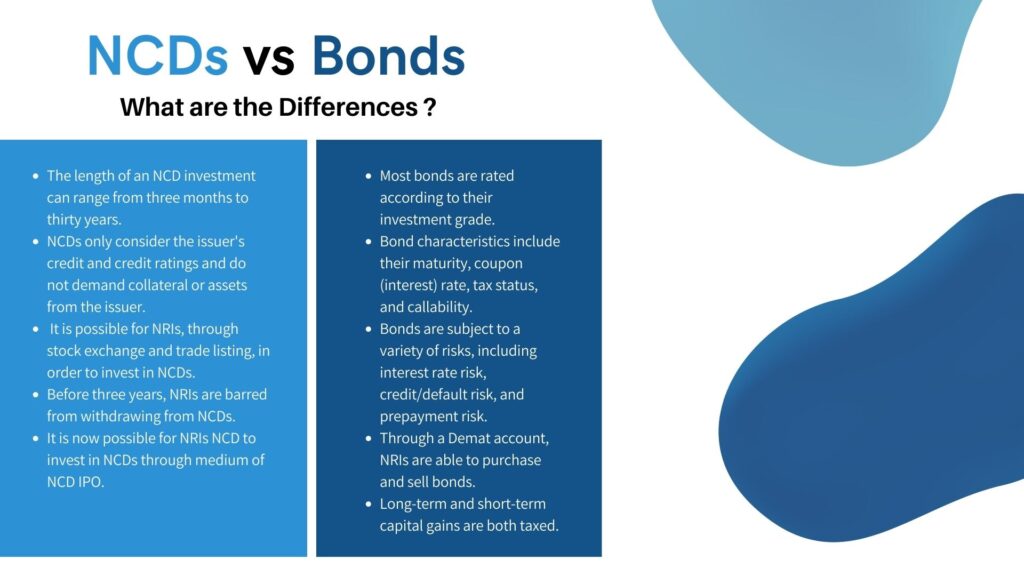

An NCD’s maturity period can range from 90 days to 20 years. This gives you the freedom to choose between short and long tenures based on your investment objectives.

To compensate for the disadvantage of non-convertibility, lenders are typically given a higher rate of return than convertible debentures. Besides that, as specified in the RBI’s NCD issue moral codes, NCDs provide a variety of other benefits to the owner, including high liquidity through stock market listing, tax exemptions at the source, and safety because they can be issued by companies with a good credit rating. In India, these are typically necessitated to have a minimum maturity of 90 days.

Is it safe to invest in NCDs?

NCDs are a great alternative for bank fixed deposits and debt funds if they are issued by reputable companies with a high credit rating. In contrast, NCDs are vulnerable to business and funding risks. As a result, if the turnover is negatively impacted, the credit rating may suffer. To offset the impact, the company will have to borrow additional funds from banks or NBFCs.

Here are some few factors that are considered prudent before deciding on investing in a company NCD:-

Tax Implications:-

It will be treated as income from other sources and taxed as and when interest accrues and is due on NCD interest income. Likewise, if somehow the holding period is less than one year and you earn a capital gain by selling it in the secondary market, it will be taxed at 10% without indexation. If your holding period is less than one year, any gain from sale will be taxed according to your tax bracket.

Credit Rating:-

The interest rate offered is the most appealing feature of NCDs. But that should not be the only reason to invest. It is critical that the company’s high interest rate is supported by good credit ratings. Before making a decision, research the credit ratings assigned to the company by various rating agencies such as CRISIL, CARE etc. A higher rating indicates that the company can repay its loans.

Analyzing requirements of Funds:-

Why is the promoter raising money at higher rates than the market? must be questioned. One must inquire as to why the company is not managing working capital if meeting short-term expenses is a requirement. It is a positive sign if a company is borrowing money to pay off high-interest loans. It is a wise use of money for a business to borrow money for the long term in order to satisfy needs.

Debt Level:-

For NCD investors, a background check on the asset quality of the company should be scrutinized and can go a long way. If the business allocates more than 50% of its assets to unsecured loans, you shouldn’t invest.

Which is better NCD or FD?

Traditional Corporate FDs or bank FDs are extremely risky compared to NCDs which can be either secured or unsecured depending on the principal sum and interest rate set by the company issuing the debentures.

A small penalty may be assessed for early withdrawals from FDs if done before maturity. Premature withdrawals, however, do not apply to all types of FDs. NCDs, however, cannot be withdrawn prior to maturity. NCDs can be sold in the secondary market because they are listed on the stock exchange.

The rates on these fixed deposits have not kept pace with rising interest rates. Although the RBI has raised the repo rate by 190 basis points since May, this has not been fully reflected in lending and deposit rates. Banks currently offer interest rates on 5-year fixed deposits ranging from 5.80-7.00%, but AAA rated NCDs offer much higher interest rates, making them more appealing than fixed deposits, making a strong case for retail investors to invest in such NCDs.

How to buy NCD online?

The company initially issues NCDs on the exchange, and they are subsequently traded on the secondary market. So, you can either subscribe when a company announces its NCD or buy later when it is trading in the secondary market. NCDs are issued by listed companies and traded publicly on the BSE and NSE. The value of an NCD offer depends on the company’s credibility, which is important to note when discussing how to purchase NCD. As a result, when selecting the best NCD offers, consider the company’s credit rating, as well as the coupon rate and the credibility of the issuers. NCDs are rated by credit rating agencies. It is best to purchase NCDs with higher ratings.