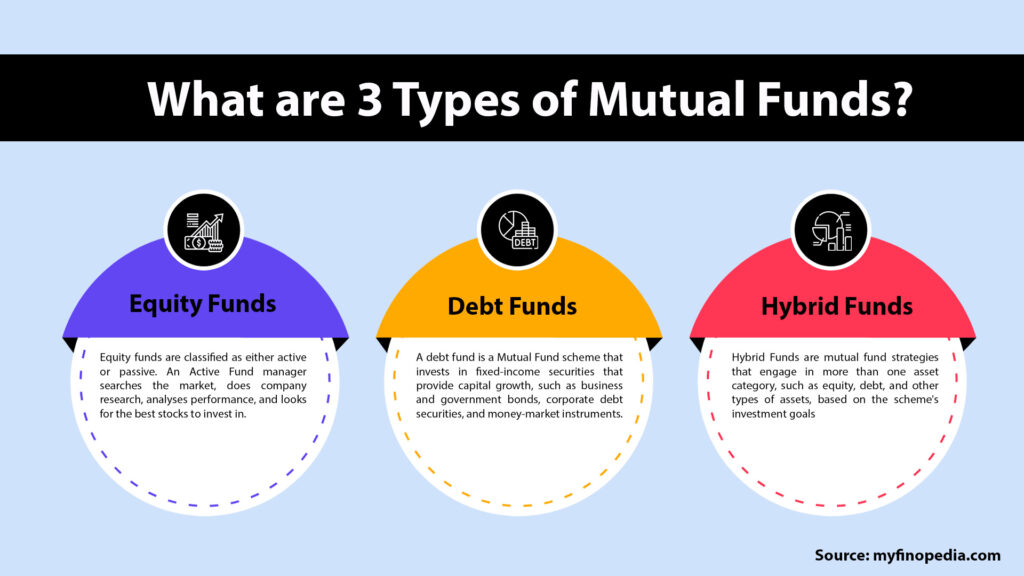

Are you thinking about putting money into mutual funds? Mutual funds are among the most popular investment vehicles in the financial markets. They are broadly classified into three types: equity funds, debt funds, and hybrid funds. This differentiation is formed based on their features, which include liquidity, assets invested in, the type of securities owned, associated risks, and so on.

While equity mutual funds are similar to stocks, fixed income mutual funds focus on corporate bonds and other assets that generate a consistent income, while money market mutual funds invest in securities with high liquidity. Each has a different set of returns, risks, and lock-in periods.

Why do people invest in mutual funds?

Mutual funds are attractive to investors because they typically provide the following benefits:

- Professional management. The fund managers research on your behalf. They select the securities and monitor their performance.

- Diversity- Also known as “Don’t put all your eggs in one basket.” Mutual funds make investments in a diverse range of businesses and industries. This reduces your risk if one business fails.

- Affordability- Most mutual funds have a low initial investment and consumer purchase threshold.

- Liquidity- Individual can simply redeem their shares for the current net asset value (NAV) plus any redemption costs at any time.

What kinds of mutual funds exist?

The majority of mutual funds fall into one of three categories: equity funds, debt funds and hybrid funds. Each has its own number of attributes, threats, and incentives.

1. Equity Funds

An Equity Fund is a Mutual Fund Scheme that focuses primarily in company shares/stocks. They are also referred to as Growth Funds.

Equity funds are classified as either active or passive. An Active Fund manager searches the market, does company research, analyses performance, and looks for the best stocks to invest in. A Passive Fund’s portfolio is built to match a popular market index, such as the Sensex or Nifty Fifty.

Additionally, Stock Funds can be classified based on Market Capitalisation, or how much a company’s equity is valued in the capital market.

Diversified categories as well as Sectoral / Thematic categories are also conceivable. The former scheme invests in stocks across the entire industry spectrum, whilst the latter is limited to a certain sector or topic, such as Infotech or Infrastructure.

Thus, an equity fund primarily invests in company shares and seeks to offer ordinary investors with the benefits of expert management and diversification.

2. Debt Funds

A debt fund is a Mutual Fund scheme that invests in fixed-income securities that provide capital growth, such as business and government bonds, corporate debt securities, and money-market instruments. Debt funds are also known as Fixed Income Funds and Bond Funds.

A few key benefits to investing in debt funds include a low expense structure, fairly stable returns, high liquidity, and reasonable safety.

Debt funds are perfect for risk-averse investors seeking consistent income. Debt funds are less risky and thus riskier than equities. If you have been saving in conventional fixed-income securities such as bank deposits and are looking for consistent returns with low volatility, debt Mutual Funds may be a better option because they help you meet your financial objectives in a more tax-efficient manner and thus earn higher returns.

3. Hybrid Funds

Hybrid Funds are mutual fund strategies that engage in more than one asset category, such as equity, debt, and other types of assets, based on the scheme’s investment goals. These funds are invested in a variety of asset classes in order to expand the portfolio and reduce risk. Hybrid funds have the potential to greatly improve debt funds in terms of returns while being less risky than equity funds.