In 2024, financial planning will require you to optimize your tax strategy. The top ten tax-saving suggestions are as follows:

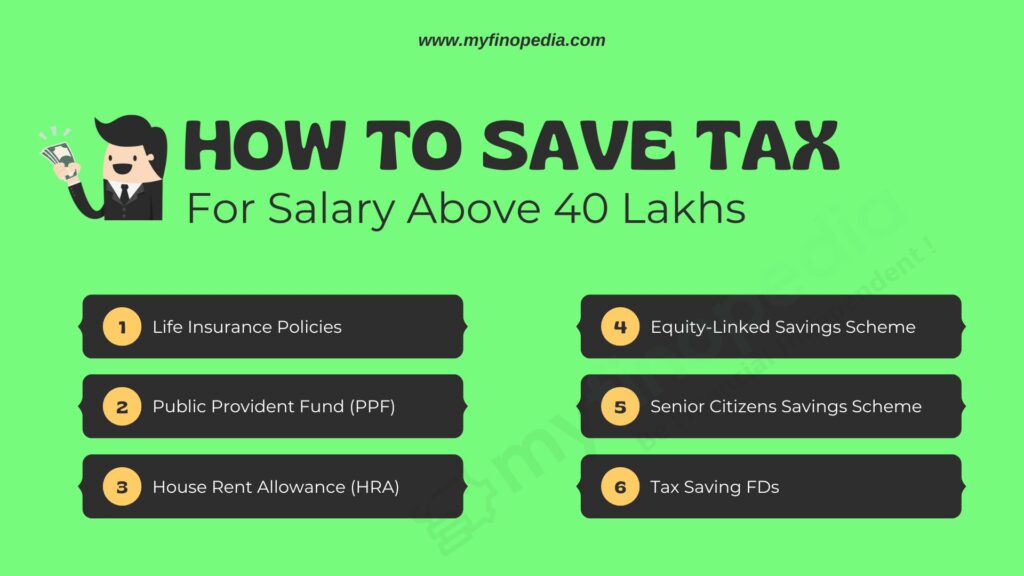

Invest in Tax Saving Schemes:

Investing in tax-saving plans such as National Pension System (NPS), Public Provident Fund (PPF), and Equity-Linked Savings Schemes (ELSS) might yield twofold advantages. Not only do these investments offer potential returns, but they also qualify for deductions under relevant sections of the Income Tax Act.

Keep Correct Records: In order to claim deductions, accurate record-keeping is essential.

Maintain documentation for all eligible expenses, including receipts for investments, medical bills, charitable donations, and home loan interest payments. This ensures a smooth filing process and minimizes the risk of missing out on legitimate deductions.

Buy Medical Insurance:

Investing in a health insurance policy not only safeguards against medical expenses but also qualifies for deductions under Section 80D. Ensure the policy covers yourself, family members, and parents, maximizing the available deductions.

Home Loan Interest Payment:

Leverage tax benefits related to home loans. Section 24 allows for the deduction of interest paid on house loans, and Section 80C allows for the deduction of principle payments. Be mindful of the applicable limits and conditions.

Get Your Salary Restructured:

Explore salary restructuring to include components that offer tax benefits. It is possible to arrange elements like reimbursements, leave travel allowance (LTA), and house rent allowance (HRA) to maximise tax savings.

Plan Long-Term Capital Gains:

For investments in stocks and equity mutual funds, plan the exit strategy to benefit from the reduced tax rates on long-term capital gains. Holding investments for more than one year qualifies for these lower rates.

Make Charity Donations:

Contributions to eligible charitable organizations can be claimed as deductions under Section 80G. Keep records of donations made, and ensure they comply with the specified conditions for claiming deductions.

Plan Expenses:

Strategically plan major expenses to maximize tax benefits. For example, consider timing significant investments or expenditures to align with available deductions in a given financial year.

Save Tax on Education Loan:

Interest paid on education loans qualifies for deductions under Section 80E. Encourage higher education for yourself or family members while benefiting from reduced taxable income.

Buy Insurance Policy:

Purchasing life insurance coverage gives Section 80C deductions in addition to financial protection. Select insurance plans that support your long-term financial objectives.

You can minimise your tax obligation while safeguarding your financial future by incorporating these tax-saving techniques into your financial strategy. To verify that these solutions are in line with current tax legislation and are tailored to your unique circumstances, always seek the advice of a financial professional.