If you’re an investor who often wants to diversify the investment base, considering Multi cap funds is one of the best options. Large-cap, small-cap and mid-cap funds often don’t align with the investor’s risk preferences. By adopting multi-cap funds, you’re making your investment portfolio more streamlined and getting extensive returns.

In this guide, we’ll provide all the necessary precautions & details regarding investments in multi-cap funds. So, get tuned in!

Meaning

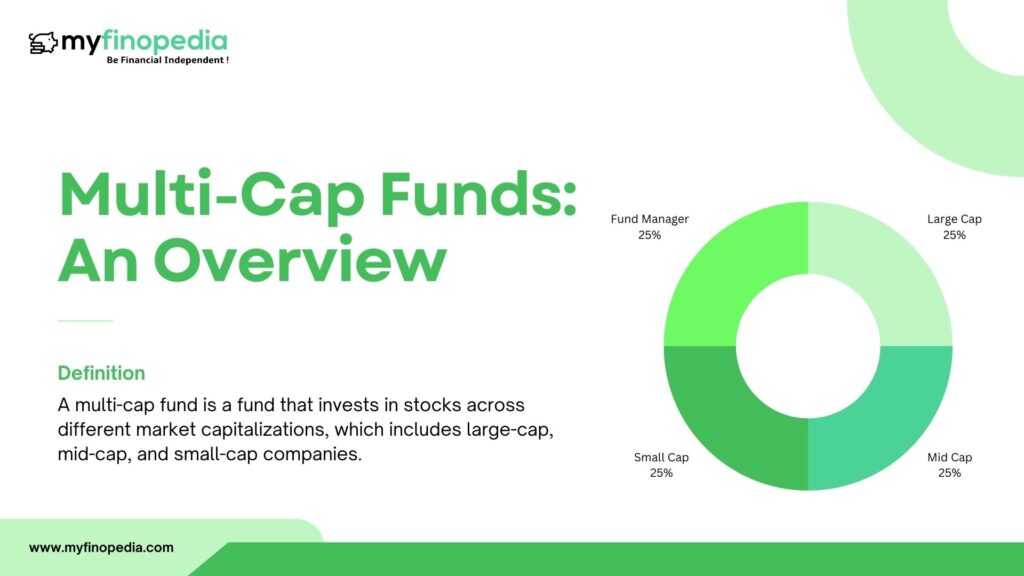

A multi-cap fund is a fund that invests in stocks across different market capitalizations, which includes large-cap, mid-cap, and small-cap companies. This provides investors with the right mix of stock across different market capitalizations.

The main pattern of investments in multi-cap funds are investing corpus of 25% each in Large, Mid & Small capital funds respectively. This makes the share option more lucrative other than investing shares in large or small capital funds.

By diversifying your portfolio, you are making it more suitable to invest in equitable funds, reducing the risk tolerance and achieving goals.

Benefits

The advantages of Multi cap funds are mentioned below:-

- Diversification:- By investing in multi cap funds then wester is diversifying stocks across different industries. This can reduce the overall risk tolerance. Also, as these funds are managed by experienced fund manager investors can benefit from the knowledge and expertise in the market prediction.

- Moderate Risk:- As the funds are managed by experienced and nuanced fund managers in large, mid & small funds altogether, it proves to be beneficial for investors who have a low risk tolerance. It is also known to withdraw good returns during market rallies from small-cap stocks.

- Long-term Growth:- Multi cap funds can be excellent choices for investors looking to grow in the long term and willing to accept some level of risk. Handled by professional market managers, it provides flexibility to adjust the portfolio according to changing market conditions.

- Liquidity: Since the investors can sell their units at any time, multi cap funds are highly liquid. Additionally, they receive the redemption proceeds within a few days.

Risks

While multi-cap funds offer, several benefits there are also some risks associated with it that investors should be aware of. Here are the few:-

- Volatility:- While investing in Multi cap funds, you are carrying the risks of getting exposed in the stock market which is extremely volatile.

- Manager Risk:- The performance depends on the expertise of the fund managers in multi-cap funds. So if the fund manager is poor in investment decisions it can negatively affect the funds returns.

- Concentration Risk:- Multi-cap funds may invest heavily in a particular sector Industry that has more concentration risks. Thus, if the sector industry performs poorly it can have a significant effect on the fund’s performance.

- Tax Implications:- Usually the tax varies in multi-cap funds. However, it is compulsory for all fund houses to deduct tax of 10% DDT prior to paying out dividends to unit holders.

Why Should I Invest in Multi cap Funds?

Multi cap funds are good investment options for investors who can diversify their portfolio for potential higher returns in future. Moreover, the professional management or their skills are highly effective to evaluate your risk appetite and objectives that can get you enough trust as an investor.

The fund managers analyse and differentiate between difference talks across different market capitalisations and select the most appropriate stock for your investment. This gives you more flexibility in terms of investment strategy and receives more returns.

Conclusion

Overall multi cap funds can be a profitable option for investors who have a well-diversified investment portfolio. By understanding how the funds work and the potential risks and rewards investors can get more informed decisions and achieve their investment goals.