In the current scenario of the business world, profitability is the ultimate measure of success. Entrepreneurs and investors continuously seek new ways to assess and enhance a company’s financial performance. One such metric that has gained significant attention in recent years is the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). While traditional EBITDA analysis has proven valuable, this article explores a unique concept that takes the EBITDA to the next level, expanding the understanding of profitability and enabling more comprehensive decision-making.

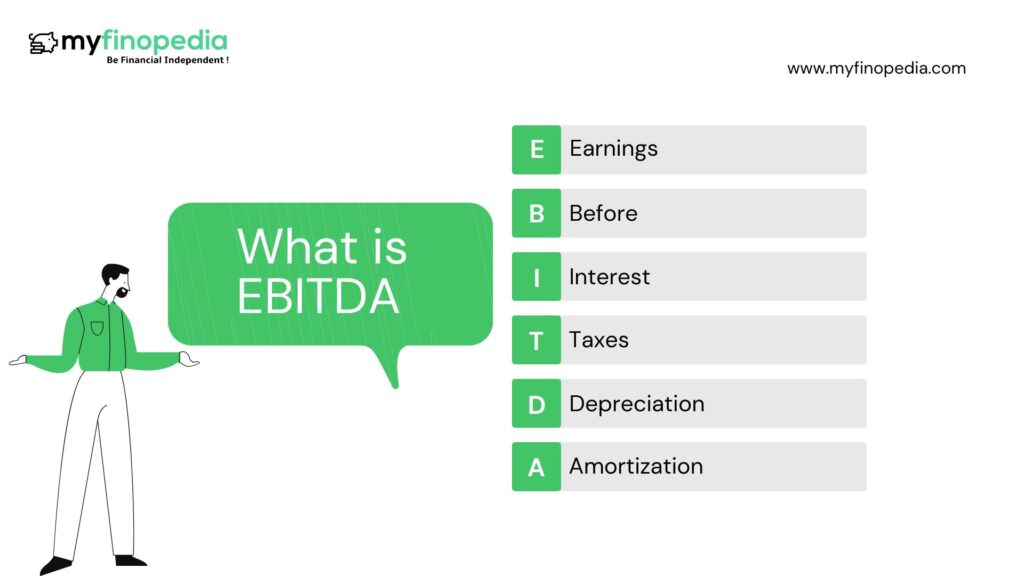

Meaning: What is EBITDA?

EBITDA is a financial indicator that reflects a company’s operational profitability by measuring it’s earnings before considering the impact of depreciation, interest, taxes, and amortization. By excluding these factors, EBITDA provides insight into a company’s core operating performance, highlighting its ability to generate revenue from its core business activities. This metric is widely used financial analysis, as it allows better comparison between companies operating in different industries or with varying levels of debt.

The Limitations of Traditional EBITDA

EBITDA is calculated by adding a company’s operating income (revenue minus operating expenses) to its depreciation and amortization expenses. It is emphasized that EBITDA should not be considered as a comprehensive measure of a company’s financial health, but rather as a tool to compare profitability and cash flow generation between different companies or industries. To overcome the limitations of traditional EBITDA and provide more accurate representation of a company’s profitability an expanded version of data can be introduced. Despite that factors cannot always be correct, EBITDA has been recognised under GAAP ( Generally Accepted Accounting Principles) as the most widely used metrics for valuation of financial statements of a company.

How does it Work?

The purpose of EBITDA concept is to provide a clear picture of a company operational profitability by excluding non-operational factors such as interest expenses taxes in certain accounting practices like depreciation and amortization. This metric helps analysts and investors compare the operating performance of companies across different industries with wearing capital structures. In spite of that, it does not account for non-operating in a mark expenses such as working capital requirements, capital expenditures, changes in debt and other factors that impact companies overall financial performance.

It is calculated by following these steps:-

- Start with the Company’s Revenue:- Begin with the total revenue generated by the company during a specific period, typically a fiscal quarter or year.

- Subtract the Operating Expenses: – Deduct the operating expenses incurred by the company, including costs such as raw materials, labor rent, utilities, marketing, and administrative expenses. The result is the operating income, also known as earnings before interest and taxes (EBIT).

- Add back depreciation and amortization: Include the expenses related to depreciation and amortization. Depreciation refers to the allocation of cost of tangible assets (e.g., buildings, machinery) over their useful life, while amortization represents the allocation of the cost of intangible assets (e.g., patents, trademarks). Adding these expenses back to EBIT gives is EBITDA.

EBITDA Formula:

EBITDA = Net Income + Interest + Tax + Depreciation & Amortization

Components of EBITDA:

- Earnings: Earnings is an important component of EBITDA, which refers to the company’s total revenue in a specific year to subtract the expenses from the total revenue.

- Interest: Another important component that impacts the costs is interest. It may also indicate interest earned.

- Taxes: Taxes imply the company’s total earnings before taxes are paid, which can bring out the EBIT.

- Depreciation & Amortization: Depreciation & Amortization respectively means the loss of value of an asset over time & writing off the initial cost of asset gradually. Both are added in the second stage of the formula.

Conclusion:

There are always evolving factors of the ever-changing business world. It is important to embrace innovative approaches to understand business. By incorporating accurate representation of a company’s profitability, we can get a comprehensive analysis of a company’s overall financial health.