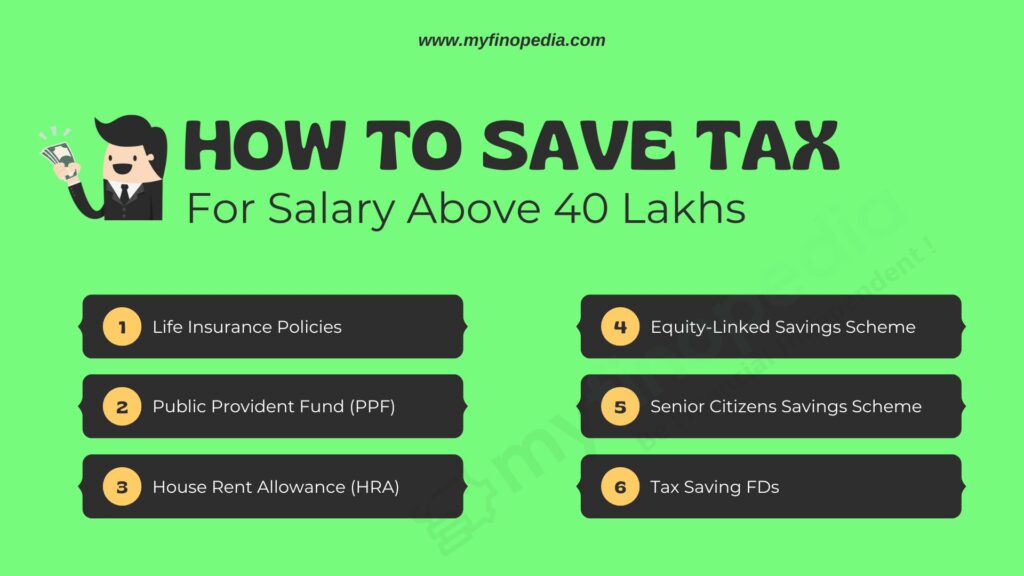

How to Save Tax For Salary Above 40 Lakhs

It’s assumed that you haven’t been handling your taxes properly if you believe you’ve been paying a significant portion of your income in taxes. There are various strategies for lowering your tax burden that offer tax deductions and other benefits. Section 80C, Section 80CCC, and Section 80CCD deductions are some of the most practical strategies …