If you’re new to the world of options, you may be wondering what the difference is between call options and put options. In this blog post, we’ll break down the key differences between these two types of options, and we’ll also give you a few tips on how to choose the right option for your investment needs.

What are call options and put options?

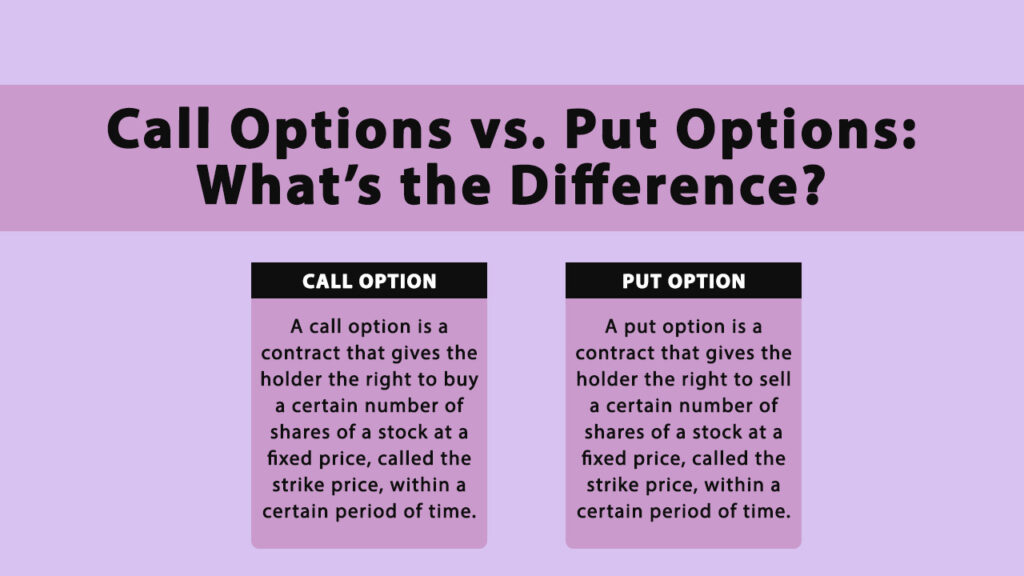

A call option is a contract that gives the holder the right to buy a certain number of shares of a stock at a fixed price, called the strike price, within a certain period of time.

A put option is a contract that gives the holder the right to sell a certain number of shares of a stock at a fixed price, called the strike price, within a certain period of time.

What are the benefits of using call options and put options?

Regarding trading options, there are two main types: call options and put options. Both have their own unique benefits, so it can be tough to decide which one to use. Let’s take a look at the benefits of call options and put options, so you can make an informed decision about which type of option is right for you.

The Benefits of Call Options

When you buy a call option, you have the right, but not the obligation, to purchase a security at a certain price (the strike price) within a certain time frame. The main benefit of call options is that they allow you to make a profit if the security goes up in price. Additionally, call options to give you the opportunity to limit your losses if the security price goes down.

The Benefits of Put Options

When you buy a put option, you have the right, but not the obligation, to sell a security at a certain price (the strike price) within a certain time frame. The main benefit of put options is that they allow you to make a profit if the security goes down in price. Additionally, put options give you the opportunity to limit your losses if the security price goes up.

Now the question is which Option Is Right for You?

Now that you understand the benefits of call options and put options, you may be wondering which option is right for you. If you are bullish on security, you should buy a call option. If you are bearish on security, you should buy a put option.

Options are a versatile investment tool that can be used to your advantage in a variety of ways. In particular, call options and put options can be used to create a variety of trading strategies. By understanding how these options work, you can use them to your advantage in the market.

How can you use call options and put options to your advantage?

A call option is a type of options contract that gives the buyer the right, but not the obligation, to buy a specified number of shares of the underlying security or commodity at a predetermined price (the strike price) during a specific period of time (the expiration date).

A put option is the opposite of a call option. It gives the buyer the right, but not the obligation, to sell a specified number of shares of the underlying security or commodity at a predetermined price (the strike price) during a specific period of time (the expiration date).

An option’s premium is the price that the option buyer pays the option writer. The premium may be paid in cash or through the delivery of the underlying security or commodity.

When is it best to use call options and put options?

When trading options, it is important to understand when it is best to use call options and put options. In general, call options are used when you believe the stock will go up, and put options are used when you believe the stock will go down.

However, there are other factors to consider when deciding which option to use. For example, if you are concerned about the stock going down quickly, you may want to use a put option instead of a call option. Conversely, if you are concerned about the stock not going up as much as you expect, you may want to use a call option instead of a put option. A call option gives the buyer the right, but not the obligation, to purchase a security at a predetermined price (the strike price) on or before a certain date (the expiration date).

If you are bullish on a stock and expect it to go up, you would buy a call option. This would give you the right to purchase the stock at the predetermined strike price on or before the expiration date. If the stock goes up, you would exercise your option and make a profit. If the stock does not go up as much as you expected, you could simply let the option expire and not exercise it. A put option gives the buyer the right, but not the obligation, to sell a security at a predetermined price (the strike price) on or before a certain date (the expiration date).

If you are bearish on a stock and expect it to go down, you would buy a put option. This would give you the right to sell the stock at the predetermined strike price on or before the expiration date. If the stock goes down, you would exercise your option and make a profit. If the stock does not go down as much as you expected, you could simply let the option expire and not exercise it. A call option gives the buyer the right, but not the obligation, to buy a security at a predetermined price (the strike price) on or before a certain date (the expiration date).

Many individuals believe that options are extremely risky, and they may be if handled incorrectly. However, investors can use options to limit their exposure while still profiting from a stock’s growth or decline.