Form 16 is an important document you might encounter when you start working or during tax season. In simple terms, it’s like a report card your employer gives you about your earnings and the taxes they’ve deducted. Let’s break down what Form 16 means, how it works, the perks it offers, and the different types you might come across.

MEANING OF FORM 16

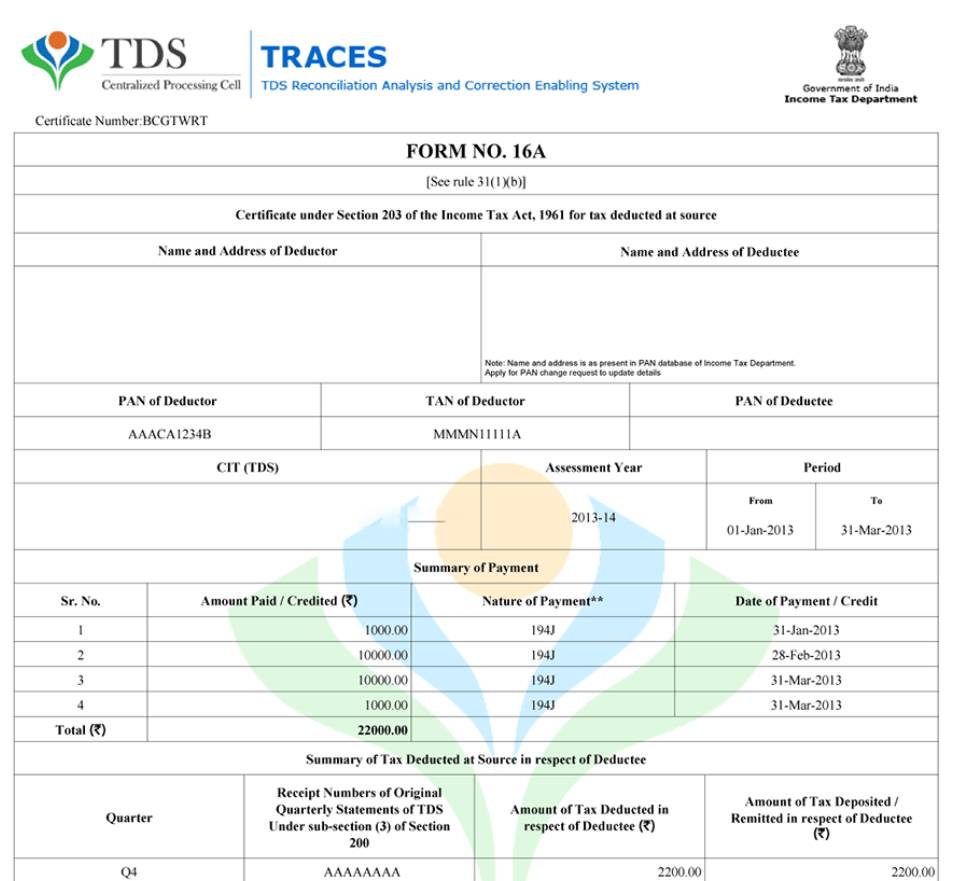

Form 16 is a certificate provided by your employer to you as proof of the tax deducted at source (TDS) from your salary. It’s like a financial snapshot, showing how much you earned and how much tax was taken out of your salary during the year.

HOW FORM 16 WORKS?

- Income Details- It lists your gross income, which is your total earnings before taxes, and then breaks it down to show how much you’ve saved in investments or claimed as deductions.

- Tax Deductions- Form 16 also highlights the taxes your employer has deducted from your salary. This includes both income tax and any other taxes like professional tax.

- TDS Proof- It’s an official record of the tax your employer has collected and deposited with the government on your behalf. This keeps you in the clear with the tax authorities.

BENEFITS OF FORM 16

Form 16 offers some cool benefits:

- Simplify Tax filling- When you file your income tax return, having Form 16 simplifies the process. It ensures you don’t underreport your income.

- TDS Credits- It shows the taxes you’ve already paid, making it easy to claim credit for them. This reduces your tax liability.

- Easy Loan Application- Some banks and financial institutions may ask for Form 16 when you apply for loans. It serves as proof of your income.

- Addressing Discrepancies- If there are any discrepancies in your tax deductions, you can use Form 16 to sort them out with your employer.

TYPES OF FORM 16

There are two types of Form 16:

1. Part A – This part of Form 16 contains details about you (the employee) and your employer. It mentions your name, address, PAN (Permanent Account Number), and your employer’s details. Part A also includes the period for which you’ve been employed and the TAN (Tax Deduction and Collection Account Number) of your employer.

2. Part B- Part B of Form 16 is more detailed. It provides a comprehensive breakdown of your income, exemptions, deductions, and the tax payable. This part also includes a summary of the taxes deducted by your employer and deposited with the government on your behalf.

In conclusion, Form 16 is a crucial document that simplifies the tax-filing process, serves as proof of your income, and ensures you get credit for the taxes you’ve already paid. There are two parts to Form 16, with Part B being the more detailed section that gives a complete picture of your earnings and tax deductions. Understanding Form 16 can make your financial life smoother, especially during tax season.