Employees’ provident fund, popularly known as EPF fund is an important fund for employees carrying many benefits for such employment. However, it is often noted that employees face consequences for not using the PF in the right way. It is associated with an authorized process, which the employees need to follow to acquire such a fund.

Here’s a quick guide that an employee should follow to run the withdrawal process of their account in a quick and effective manner.

How to Withdraw the PF Amount Online?

Below are the details provided where you can simplify the process of PF withdrawal at ease.

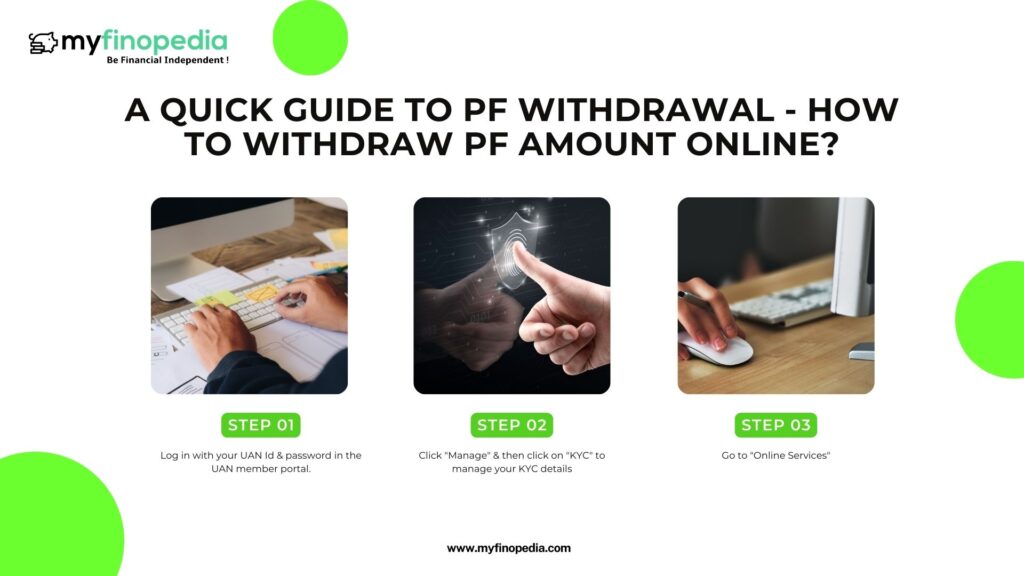

Here is a step-by-step process:-

- Log in with your UAN Id & password in the UAN member portal.

- Click “Manage” & then click on “KYC” to manage your KYC details

- Go to “Online Services”

- Click on “Claim (Form 31, 19, 10C & 10D)”

- Your “Member Details”, “KYC Details” and “Other Details” page will open.

- Enter “the last 4 digits of your bank account no.”

- Next click on “verify”

- You can proceed if your bank account no. & IFSC code is right

- Next proceed on “online claim” if you’re eligible

- Click on “confirm if you’re eligible”& proceed

- Before clicking on form check & update current residential address

- Now select, “Form-19 & 10C”

- Get your “Aadhar OTP” in your registered mobile number

- Finally “Enter the OTP”

- “Validate” and then wait for sometime

- Finally, your pdf for “online claim will be generated.”

Generally, the claiming process takes 15-20 days to transfer the said amount to your bank account, but still it’s easier to get processed online. Whether you’re withdrawing your EPF while in retirement, or even in emergencies, this procedure will take you through a simple process of withdrawing your payment. Also, once you’ve attained 55 years of age, only then you can withdraw a partial amount of your EPF account.

Overall, it’s a seamless process to get your EPF amount online. Make your purpose clear and consider with your employer before releasing the loan amount. Without the employer’s due permission, you may be bonafide employer in your EPF account.