In its simplest form, risk appetite means the amount, rate, or percentage of risk an individual, or organization is willing to take in return for its plan or targeted objectives. Amount of risk which an individual is prepared to take is termed as risk appetite. Each individual works for some goal or has some aspirations. To fulfil these aspirations, there are certain plans and strategies which are required. There can be some risks and uncertainties which are associated with the execution of these plans and strategies. To capitalize on the specific purpose, an individual has to do the cost-benefit analysis. They should come to a point where they feel that this is the amount of risk that’s worth taking.

For an organisation, risk appetite can differ and is based on several factors, including industry, company culture, competition in the industry, nature of the objectives, financial strength and capabilities, etc. An organisation which has more resources and solid financials is the one willing to take more risks and the costs associated. Another important factor which needs to be kept in mind is that risk appetite can change over time. Therefore, it is always advisable to assess risks against risk criteria. This assessment can be done periodically or on a continuous basis. Frequency of the assessment depends on the circumstances, available resources, skills, etc.

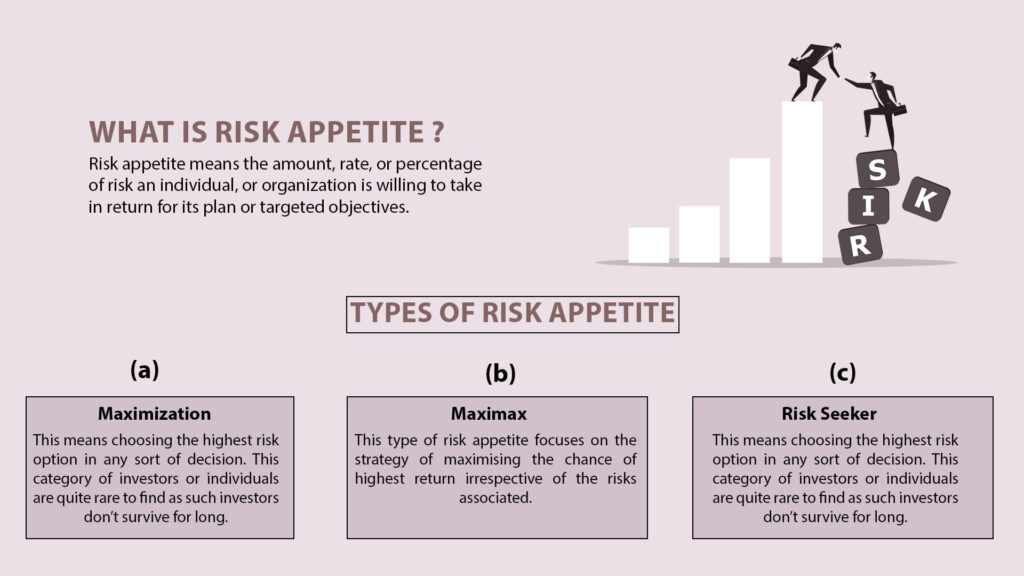

Types of Risk Appetite

- Maximization

This means choosing the highest risk option in any sort of decision. This category of investors or individuals are quite rare to find as such investors don’t survive for long. Adequate balance needs to be maintained between risk and return.

- Maximax

This type of risk appetite focuses on the strategy of maximising the chance of highest return irrespective of the risks associated. For example, a gambler who plays the biggest game in the casino and pays no attention to the risks associated.

- Risk Seeker

This category of risk appetite means individuals who are willing take high risks, but only the calculated ones. They believe in taking high risks as long as they are rational. For example, an investor who purchases shares which are equally likely to rise 3x or fall 60% within a month.

- Risk Neutral

This category includes individuals who are comfortable with the risk, provided it is for the good reason. This category includes risks which are taken rationally based on an analysis of risk-reward. An example will include a person who has taken a risky career choice. That individual knows that the risk element is high, but he/she is willing to accept because they know its important and it will be beneficial over the long-term.

- Pareto Risk

This category of risk appetite is also known as 80-20 rule. It stipulates that ~80% of the effects or results are due to ~20% of the causes or invested input.

- Risk Averse

Individuals falling in this category prefer to go for safest choices in the list of options. Sometimes these individuals are faced with higher secondary risks. Example will include an investor who is not investing in the stock market because its risky, but is also failing to preserve the value of money because of higher inflation.

- Minimax

Investors in this category try to minimize the dread risk. Dread risk means a risk which invokes strong emotions, primarily fear.

- Minimization category

This category focuses on minimizing each and every risk, irrespective of the expenses involved.